30 Seconds to Protect Yourself

*All Fields are Mandatory

Date Of Birth *

Gender *

Please Enter Valid Details

Policy Term *

Claim Type *

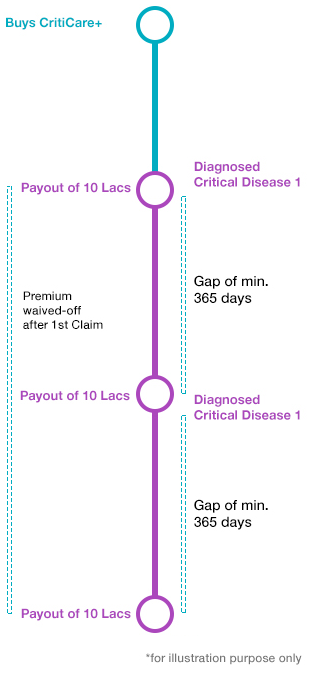

Claim up to 3 times upon diagnosis.Refer to FAQ for details.

Your Annual Premium